Table of Contents

Editor’s be aware: Looking for Alpha is proud to welcome Hansen Music as a new contributor. It’s effortless to become a Searching for Alpha contributor and make dollars for your very best financial investment suggestions. Energetic contributors also get totally free obtain to SA High quality. Click right here to discover out a lot more »

jetcityimage/iStock Editorial by way of Getty Images

The To start with Have faith in S-Network Upcoming Cars & Technological innovation ETF (NASDAQ:CARZ) is poised to capitalize on a generational shift in the direction of electric powered vehicles. I price it a Hold for now, but only mainly because macroeconomic conditions this sort of as an growing fascination price will dampen need and a global semiconductor lack can limit provide.

How can an ETF devoted to a transforming, present day industry, issued by a prominent ETF supervisor and in existence for 12 several years, amass only $42 million in assets and only trade about $250,000 a working day in volume? I honestly do not know, and that’s why I made a decision to create about it. Due to the fact to me, CARZ is an undiscovered automotive ETF that has the opportunity to supply important future revenue.

The fund efficiently captures the global automobile manufacturing field, giving a combine of regular and modern-day gamers. Its inventory holdings include major automobile producers as well as pioneers pushing the boundaries of fashionable technology. The vehicle sector is suffering from a transformation stage, pushed by improvements in automotive know-how and a developing change to electrical autos. CARZ gives an option for buyers to tap into this shifting marketplace.

It’s essential to keep in mind that whilst this transformation is revealing tremendous advancement potential clients, it is not without having its personal established of worries. There is however a sizeable total of uncertainty bordering the sector as it contends with road blocks this sort of as a absence of uncooked production supplies, which have led to output problems.

Current automakers are starting to reorient their enterprise techniques to adapt to the increasing desire for electric automobiles and improved technological know-how. At the same time, more recent franchises concentrating solely on electric and self-driving vehicles are soaring in prominence as effectively. Incorporate this with sophisticated technologies, these as autonomous driving functionalities and IoT connectivity in automobiles, and there is likely for major upside probable within this industry. These improvements are boosting car performance and further integrating automobiles into the technological sphere of our life.

The place classic and futuristic car enterprises coexist

Launched and managed by Very first Have faith in Advisors L.P., CARZ adopts a administration system that aims to track and replicate the functionality of the S-Network Electric powered & Future Motor vehicle Ecosystem Index. This index includes corporations generally concerned in the manufacturing of cars and its enabling systems and products. The ETF won’t discriminate in between classic and modern manufacturers, therefore delivering a blend of balance and opportunity advancement. In spite of its worldwide focus, CARZ leans towards organizations primarily based in formulated markets, delivering a harmony concerning chance and prospect.

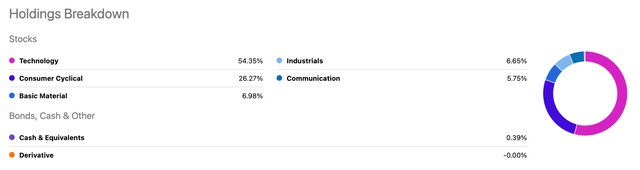

Legacy franchises like Typical Motors and NVIDIA occupy a major part of the holdings, bringing steadiness and regular efficiency. At the similar time, providers major the automotive revolution, like Tesla, present significant expansion probable. In addition, the ETF also provides a sizeable part of leading know-how giants, such as Apple and Microsoft. Shopper Cyclical (vehicle manufacturers) and to a smaller extent, Industrials and Basic Materials (auto pieces suppliers) depict a smaller focus of the fund. This combine, along with the addition of electronic know-how, supplies an considerable publicity to the overall vehicle value chain, developing a equilibrium between cyclical steadiness and potential advancement. Down below is a breakdown of the fund’s holdings by marketplace.

In search of Alpha Seeking Alpha

Mega-cap tech, with an vehicle marketplace filter

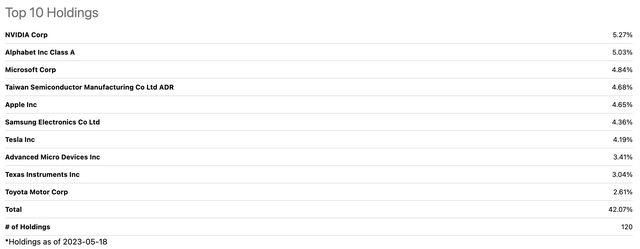

CARZ has the ability to offer a broad exposure to the reworking worldwide vehicle industry. Latest holdings Tesla (TSLA) , Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Apple (AAPL) have all risen in value by at least 25% this 12 months. Automobiles are getting more like computers now, and these big tech providers are growing their impact to most fashionable automobiles. This is significantly notable thinking of the equivalent distribution concerning tech and sections manufacturing corporations and standard car makers in just the CARZ portfolio.

At about $52, it is marketing 20% underneath its peak in November of 2021. That places it in maintain vary for me, the place it really is a little undervalued but I would somewhat see when all all those Large Tech holdings turn into more reasonably priced. Other than Tesla, there is not any other automotive organizations in the Best 10 other than Toyota. This enables the fund to profit from the technological developments in just the automotive industry as opposed to only focusing on the vehicle business by itself.

On top of that, the fund is likely to profit from the outstanding progress shown by organizations like NVIDIA (NVDA) and TSLA. These firms get up a substantial portion of the fund, as shown in the Top rated 10 Holdings down below, strategically positioning it to capitalize on rising traits, together with the growing shift in direction of electrical cars and the breakthroughs in autonomous driving technological know-how.

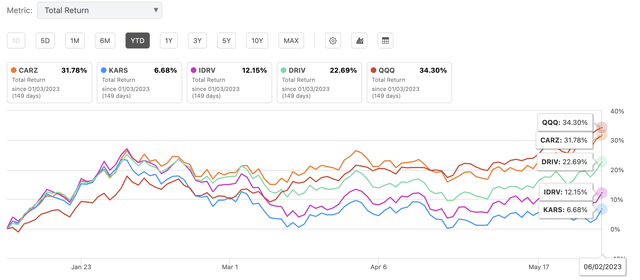

And due to the fact of its twin emphasis on electrical autos alongside technological progress in this area, the surge in the Nasdaq considering that final autumn has obviously benefited CARZ far more than some of its rivals. Amongst its friends, DRIV, IDRV, and KARS, CARZ’s Full Return clearly prospects the bunch in 2023 at approximately 32%. The fund has most closely followed the QQQ this earlier calendar year, top me to conclude that CARZ is the very best alternative for an automotive ETF out of the bunch. Also, CARZ’s outperformance is primarily outstanding when thinking about its AUM of $41 million. To put in standpoint, the fund with the 2nd most affordable AUM in the group, KARS, offers a substantially increased AUM at $170 million. This means that CARZ experienced to defeat quite a few cons, which includes reduced quantity and liquidity among the others, in order to continue to come out on best between its friends.

Searching for Alpha

The EV sector and Tesla’s prominence

There is certainly a developing shift toward electric autos as well as developments in autonomous driving technologies. These ahead-searching marketplace traits phone for major opportunity upside in owning CARZ in the in the vicinity of term. Contemplating Tesla’s recent strategic price reductions on its autos, you will find potent opportunity for the business to excel in the around term. This strategic move could possibly marginalize rivals, permitting Tesla to protected a broader market place stake, at least momentarily as competition strive to acclimate to evolving sector developments. Supplied Tesla’s popular place in the CARZ portfolio, these a surge in Tesla’s effectiveness could directly bolster the fund’s advancement trajectory.

Cyclical headwinds stand for the most important dangers

Getting seriously reliant on the cyclical character of the auto business, it is inclined to fluctuations in world-wide economies and purchaser paying out, and the fund can specially be harm by the predicted economic downturn. The vehicle field is also delicate to desire level variations, notably in markets wherever consumer car or truck funding is prevalent. As the Fed alerts to possible fascination price hikes to battle inflation, shopper demand from customers for new automobiles may perhaps lower, which can in flip negatively effects gross sales of vehicle organizations. On top of that, inspite of the opportunity benefits of technological breakthroughs, there are even now issues bordering the collective acceptance of electrical and self-driving vehicles, which might eventually slow progress in the early phases of its progress as folks modify to new technological innovation.

Even with the promising options and latest gatherings, CARZ does confront prospective threats that could impression its around-expression effectiveness. According to JP Morgan analysts, the latest world-wide semiconductor chip shortage poses a important obstacle to auto creation, predicted to final into 2023 and 2024. However, when the semiconductor supply normalizes, we can count on world-wide auto pricing to regain security, rising manufacturing and product sales in the marketplace as a entire. Together with the semiconductor lack, there is also a lack of electric motor vehicle battery products. With materials like nickel and lithium nonetheless underground, we can anticipate a surge in collaboration among automotive firms and miners, with automotive corporations turning into more concerned in the mining enterprise.

Belief: Brief-term dangers never have an affect on prolonged-phrase likely

As an ETF committed to the world auto industry, CARZ gives an interesting way to observe an industry going through innovative improvements. From the rapid developments in electrical automobile (EV) technologies to the emergence of autonomous driving, CARZ encapsulates these dynamic shifts, earning it a valuable addition to my watchlist. It really is not just about likely expenditure returns tracking CARZ is about keeping a finger on an industry which is set to redefine how we understand and benefit from particular transportation in the future.

I price CARZ a Hold for now. This final decision balances the significant growth probable in the transformative car field against the existing uncertainties that could halt in the vicinity of-phrase general performance. Components like the international semiconductor and raw material shortages and macroeconomic problems ought to be taken into account. Though these cyclical issues warrant a degree of caution, I foresee them to be incredibly minor, short term implications that can be navigated and solved inside of the in close proximity to time period. Having said that, as the market evolves and navigates by means of these issues, I am assured that a reevaluation of CARZ would direct to a much more bullish stance in the potential.